Last updated: 3 December 2024

Next review: 3 June 2025

This content is part of the Waltham Forest JSNA. To see other JSNA content, visit the JSNA landing page

The rate of suicide deaths is seen as an indicator of underlying rates of mental ill-health.

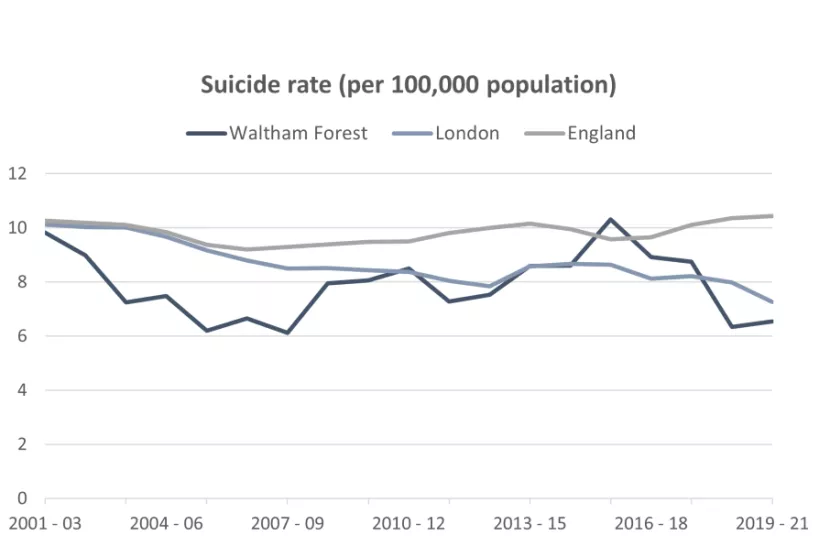

Nationally, rates of suicide have remained stable over the last 10 years, varying between 9 and 10 deaths per 100,000 population. Waltham Forest has generally had rates that are lower than the national average, with 6.5 deaths per 100,000 in 2019-21; this is significantly lower than the national average of 10.4, and similar to the London average.

There are large inequalities in suicide rates between males and females. In Waltham Forest, suicide rates were significantly higher amongst males than females in 2019 to 2021 (10.7 per 100,000 in males, while rates in females were too low to be calculated and published).

Unlike other preventable causes of death, suicide rates do not have a clear correlation with levels of deprivation. Although the least deprived areas in Waltham Forest have significantly lower rates than the borough average, the rates of suicide across the population are broadly similar.

Source: OHID Public Health Outcomes Framework. Data based on Office for National Statistics source data. Date accessed: 7 July 2023.